Mobile Payments’ Pros & Cons (Infographic)

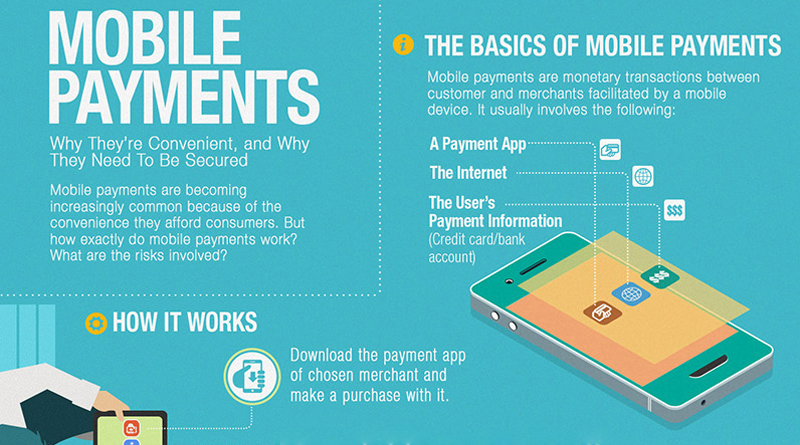

Mobile payments are becoming more commonplace these days as the monetary transaction between a customer and a merchant through a mobile device offers consumers a much more convenient payment method.

It usually involves a payment app, an Internet connection, and the user’s payment information – typically their credit card or bank account.

These payments are made through a downloaded payment app of the chosen merchant. The user then inputs his or her information into the mobile app to proceed with the payment. The mobile app then contacts the merchant and the customer’s bank through the Internet to be able to process the payment. Once the bank and merchant approve the transaction, the customer is notified that it is complete.

Mobile payments also offer other conveniences and privileges to attract customers. One of these privileges is exclusive in-app discounts, which are season-based discounts exclusive to the merchant or app.

The mobile app’s ease of use makes it accessible to any customer with a smartphone or tablet and an Internet connection. Also, the improved security measures of mobile payment employ multiple layers of protection.

(Click on image for full infographic)

(Click on image for full infographic)

The mobile device’s operating system (OS) integration improves the security and efficiency of the payment transaction. There is also a steady rise in the number of merchants and retails organisations which accept this method. Lastly, the risk of exposure to point-of-sale threats like card skimmers are minimised through mobile payments.

Mobile payments, however, are not a hundred percent foolproof.

Man-in-the-middle attacks are one of the threats to mobile payments; this happens when a third party disrupts the online connection between a customer and a merchant – usually a fraudulent mobile app pretending to be the legitimate app. This leads to a compromised customer account or loss of money.

Another threat would be data breaches. This is when a merchant’s customer database is hacked and the information is stolen by the attackers. The customer’s information could then be used for malicious purposes such as identity theft or online banking account compromise.

A mobile payment app could have flawed coding or processes, as well. A customer’s personal or banking information could leak because of this, while unauthorised transactions or identity theft could also occur.

While mobile payments pose more than a few risks, it is still more secure than traditional payment methods. Users can make their mobile payments safe through these simple tips recommended by Trend Micro’s TrendLabs:

- Don’t transact payments while connected to unsecured networks.

- Use strong and unique passwords for every payment account or mobile app.

- Never leave your mobile device unattended.

- Install a mobile security solution.

Comprehensive multi-device protection for you and your family for up to 6 PCs, Macs, Android, and iOS devices. For more info click here.